U.S. Economy Booms with $23B Tariff Surge, but $316B Deficit Signals Fiscal Recklessness

Inflation Dips to 2.4% and GDP Growth Hits 3.8%, Yet Rising Debt and Fed Caution Spark Concern

In May, tariff revenue increased by $23 billion, a jump from February, adding to the government's coffers. Inflation has eased to 2.4%, a welcome relief, while the Atlanta Fed predicts robust GDP growth of 3.8% for the second quarter. These figures show initial economic resilience.

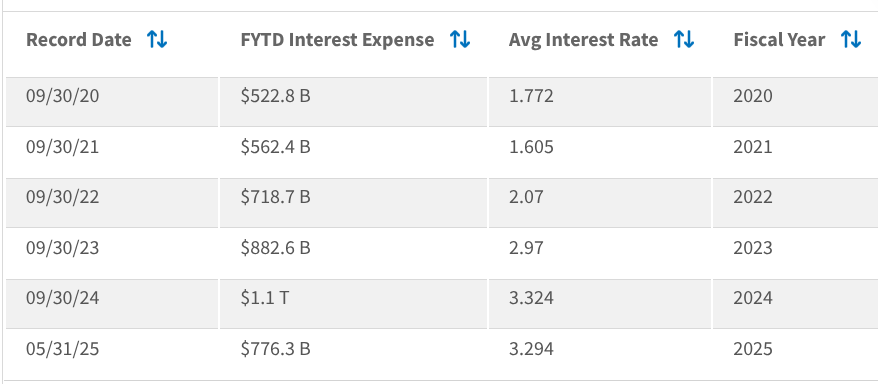

But, spending is up 13% from 2024, 20% from 2023, and 65% from 2022. The U.S. posted a $316 billion deficit in May, with $90 billion funneled to interest payments on the national debt. This fiscal recklessness threatens our long-term economic freedom, echoing libertarian warnings about unsustainable government overreach.

The debate over tariffs splits Americans; some champion them as a success, citing increased revenue and economic growth. Other Americans, however, remain wary, suggesting tariffs could raise prices and weaken the economy over time. For libertarians, this tension reflects a broader question: do trade barriers protect sovereignty or stifle free markets?

Meanwhile, the Fed’s role sparks heated discussion. Many feel that Federal Reserve Chair Jerome Powell is playing politics, potentially resisting interest rate cuts to avoid aiding Trump’s agenda, despite conditions favoring a reduction. A 100-basis-point cut could save us $300 billion in interest payments and spur growth, potentially slashing the deficit alongside tariff gains. Although Powell’s caution may stem from a fear of inflation, remembering the past Federal Reserve missteps under Biden.

Cutting rates could juice up the GDP and ease fiscal pressure, but risks reigniting inflation. Should Powell take action or should he take a slow, prudent approach and wait?

It is sad to see the Republican Party’s drift from free trade and relatively open borders (i.e., the Reagan era) as it challenges its historical roots. This fusion of state and economy—whether through tariffs or monetary policy—erodes individual liberty and market autonomy.

The lesson is clear—government meddling, whether through trade barriers or central banking, risks long-term prosperity for short-term gains. As the national debt balloons and economic policy bends to political winds, the call for fiscal restraint and market freedom grows louder.