Trump’s Tariff Plan: A Tax-Free Dream or Economic Nightmare?

Could tariffs replace income taxes? Fair Tax might offer a better solution.

Donald Trump has floated the idea of replacing the federal income tax with tariffs. He and Kamala Harris are throwing ideas out there to see what sticks. First and foremost, we should focus on reducing spending rather than finding more ways to spend. Additionally, we should be concerned with the growing rejection of the U.S. Dollar as the global reserve currency.

Let’s look at Trump’s tariff-based proposal to eliminate income taxes in favor of tariffs (taxes on imported goods). While eliminating having to file our federal income taxes yearly would be welcome, it isn’t without costs. Let’s look at the positives of his plan first:

It would simply be the nation’s tax filing situation since tariff taxes would be paid when imported goods are imported.

Less focus on American income levels.

Individuals and businesses would keep 100% of their income, potentially enabling them to spend more in the economy.

4) Increase domestic manufacturing and investment.

With all those positives, it would seem like a great idea, but is it? No, it is not. It would be regressive and likely negatively affect our economy. It would also cause sticker shock when people go out and buy something, only to realize how expensive everything would need to become to pay the tariff tax—ultimately causing dramatic inflation at the register. While seemingly beneficial in some aspects, Trump's tariff plan could lead to significant economic challenges and hinder the free market from thriving.

It is just not a workable plan. The U.S. Treasury raises about $2 trillion from individuals and corporations. Yet, the federal government spends $5-6 trillion annually. To increase the $2 trillion, tariffs would have to be so high it would send imports into a tailspin, let alone if tariffs were used to plug the deficit, it would be a complete economic disaster.

In 2023, the U.S. imported goods worth roughly $3.3 trillion. For tariffs to replace the lost $2 trillion from income taxes, the government would need to apply extremely high tariffs on a substantial portion of these imports. This would significantly increase Americans' living costs, as the prices of imported goods would skyrocket.

To put it in perspective:

Current average tariff rates in the U.S. are relatively low, often around 2-5%. These rates generate only a small fraction of federal revenue, about $80 billion annually.

To raise $2 trillion through tariffs, the government must impose tariffs averaging 60% or higher on imports. This astronomically high rate would have devastating economic consequences.

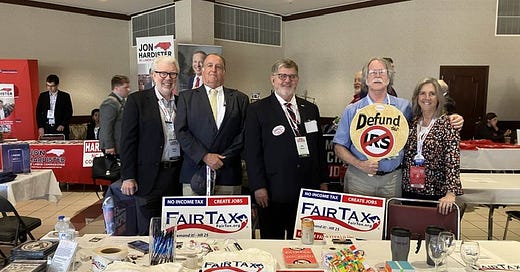

Perhaps Trump should look closer at the Fair Tax proposal (as advocated by FairTax.org), which is superior to Trump’s tariff-based plan for several reasons. So, let’s explain the Fair Tax as many have incorrect notions about it, and it is often confused with the Flat Tax. The Fair Tax replaces all federal income, payroll, and corporate taxes with a flat sales tax on new goods (not used) and services. It proposes a 23% sales tax on most consumer purchases. In theory, everyone pays the same rate, and individuals are only taxed based on what they spend, not what they earn—basically a national sales tax collected at the register. Like Trump’s tariff plan, everyone would enjoy receiving 100% of their paycheck (no payroll taxes, etc.) and help the poorest among us by offering a rebate to offset essential spending. Every household would receive a monthly payment from the government equal to the amount of tax they would pay on essential goods and services up to the poverty level. This prebate would allow lower-income individuals to cover basic needs without paying any net taxes on those necessities. For example, A family of four would receive a rebate that essentially reimburses them for the Fair Tax they would spend on essentials like groceries, housing, and utilities.

Since the prebate is universal, everyone receives it. Still, it has a proportionally greater impact on those with lower incomes because they spend a larger portion of their income on essentials.

The Fair Tax has several positives by eliminating the IRS since, as Trump likes, it would eliminate the federal income tax, it would broaden the tax base by eliminating income tax brackets, spreading the tax burden to a wider base, including foreign tourists and illegal aliens since they all spend money in the United States. The Fair Tax decentralizes tax collection while encouraging savings and investment. Compared to the current tax system, the Fair Tax is simpler, more inclusive, and encourages economic growth.

Again, a far better idea is to get our financial house in order and dramatically reduce federal spending so we can stop adding to the federal debt and shrink the deficit. Trump’s tariff-based and Fair Tax systems stop that; they only work to make life easier for Americans and are designed to be somewhat revenue-neutral.

The Fair Tax is superior to the tariff-based system as it maximizes the freedom of Americans to choose whether or not to pay the tax since they could be used goods over new, etc. It avoids market distortions (outside of whether to buy new or used goods), it minimizes government control, unlike the tariff-based system, and taxes paid at the register would be transparent to the consumer/taxpayer as opposed to the tariff-based system where the tax is hidden at the import level.

The FairTax is non-discriminatory and has a voluntary feature that appeals to Americans. It dramatically simplifies the American tax system while eliminating our intrusive government peering into our incomes and promoting personal liberty by letting them decide how or if they will pay or avoid the tax. The tariff-based system proposed by Donald Trump is appealing as it also eliminates income taxes but is at the risk of distorting the markets and increasing government intrusion into business.