MSTR's Bitcoin Bet: Big Gains, Big Risks

Michael Saylor's strategy: Borrowing at 0% to buy Bitcoin, transforming MSTR into a Bitcoin giant.

So, this article will be boring and ignored by many; others will enjoy it, most notably me! I have been somewhat passionate about Bitcoin for quite some time, and, somewhat recently, I have been interested in Michael Saylor’s strategy to transform his Microstrategy (MSTR) public company. I have written extensively about Bitcoin, Michael Saylor, and Microstrategy; search this Substack archive to read them.

I came to know Bitcoin back in 2012 when friends in Miami were advising me to “mine” Bitcoin via the computers I owned, which I did, yet I did not know what I was doing, and while I had a couple of computers “mining” Bitcoin 24/7, most of that was lost since I do not know my 12-word passphrase, etc. I’m one of those idiots you hear about who lost his Bitcoin fortune; though there is no need for a pity party for me, I view it as not only a great education but a large contribution to the future of Bitcoin (only some will understand this concept).

So, let me break this down in super-easy terms to help you understand Microstrategy’s Bitcoin strategy. Let’s say you put aside a certain amount of your income in a special bank account. Still, instead of giving you a paltry 1 to 5%, this special bank account grows your money faster than everyone else, even exceeding Bitcoin’s returns.

How did this special bank account (MSTR) grow so fast? Instead of the standard bank investing their deposits in loans, bonds, and government securities, your special bank account buys a LOT of Bitcoin. Think of Bitcoin as a rare trading card with a very limited supply and high demand, so its value can go up a lot. This strategy has made Microstrategy a lot of money (increased value per share) in 2024.

That is just one phase of MSTR’s strategy to maximize profits with Bitcoin. In 2024, Saylor started borrowing money for essentially zero interest (selling convertible bonds for MSTR shares) to buy more Bitcoin. Rinse and repeat, like a snowball going downhill, getting larger and larger.

Saylor’s strategy with MSTR has meant that more and more people and large financial institutions trust and believe in Bitcoin as much as Saylor, increasing the number of Bitcoin Maximalists. MSTR shows everyone that Bitcoin can be a good way to save and grow money.

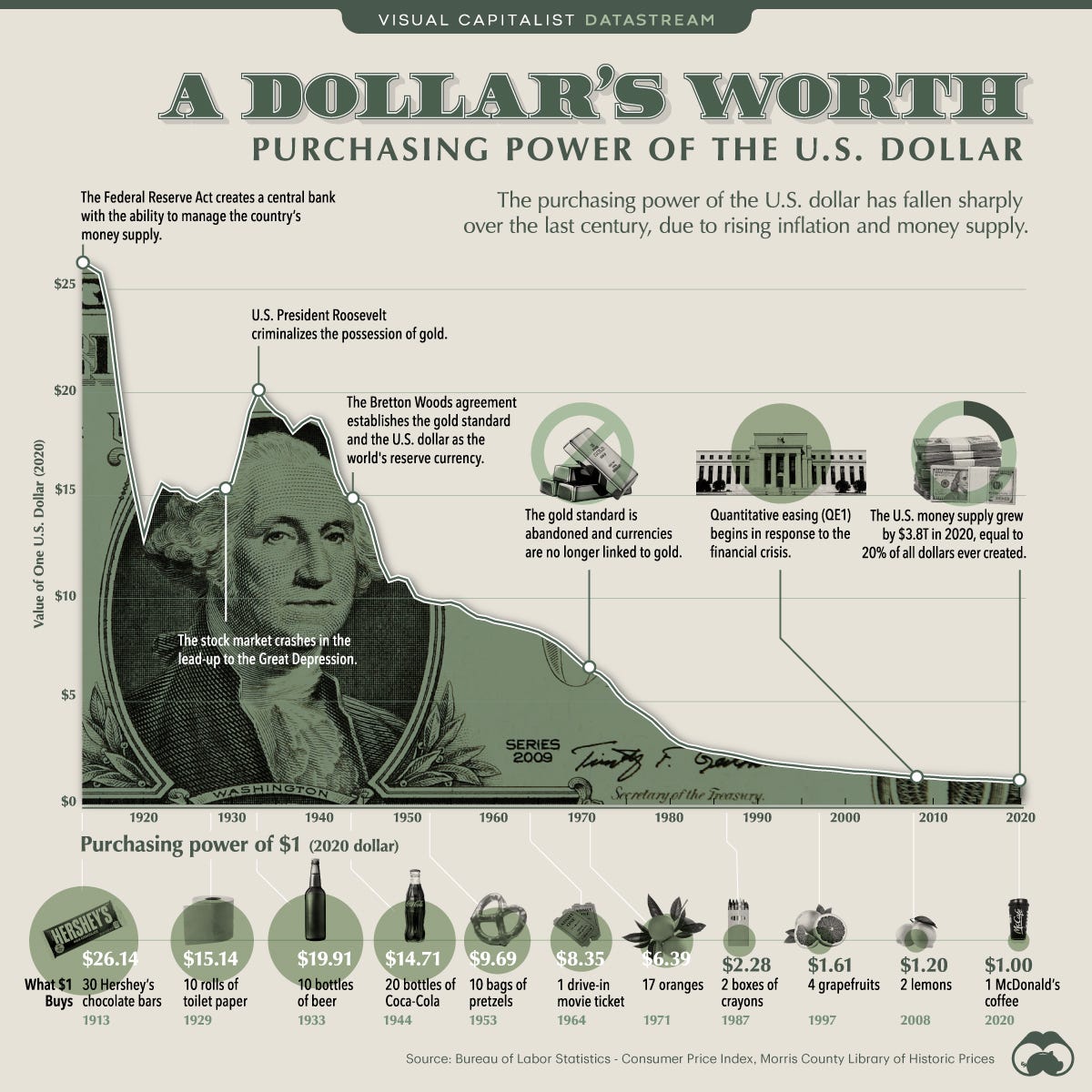

Now, while the price of Bitcoin in U.S. dollars can fluctuate dramatically, its overall long-term trajectory has been predictable.

MSTR offers people a traditional way to own Bitcoin if they do not want to own it directly for whatever reason (too difficult, they don’t understand it, they don’t want to have a Bitcoin wallet, etc.).. So people buy MSTR instead of Bitcoin, which has helped propel the value of MSTR faster than the actual Bitcoin.

People are buying Bitcoin as they see it as a serious contender as currency for when the U.S. Dollar ultimately tumbles to zero.

MSTR’s Bitcoin strategy has a few components:

Bitcoin is future money since it is rare, and no more will be created (limited to 21 million Bitcoins).

Buy a lot of Bitcoin as its value will increase in the long term.

MSTR is to lead others to profit from using their corporate treasury out of US Dollars and into Bitcoin.

Ability to take on the risk of fluctuation for large, long-term returns.