Congress Fuels Inflation With Reckless Spending, Ignoring Reality

Unchecked money printing and debt soar, creating a bleaker tomorrow.

Some members of Congress have claimed that printing money to cover federal spending won’t necessarily lead to inflation. Yet, many studies show the opposite, of course, including this one from MIT, showing that federal spending was responsible for the 2022 spike in inflation. Yet Congress and the president continue spending like there is no tomorrow. And as we know, there is a tomorrow, and it looks bleaker and bleaker the more our federal government continues its unconscionable spending spree.

This demonstrates a fundamental misunderstanding of monetary policy. When the government prints more money without corresponding economic growth, it devalues the currency and increases demand without increasing supply, which typically results in inflation.

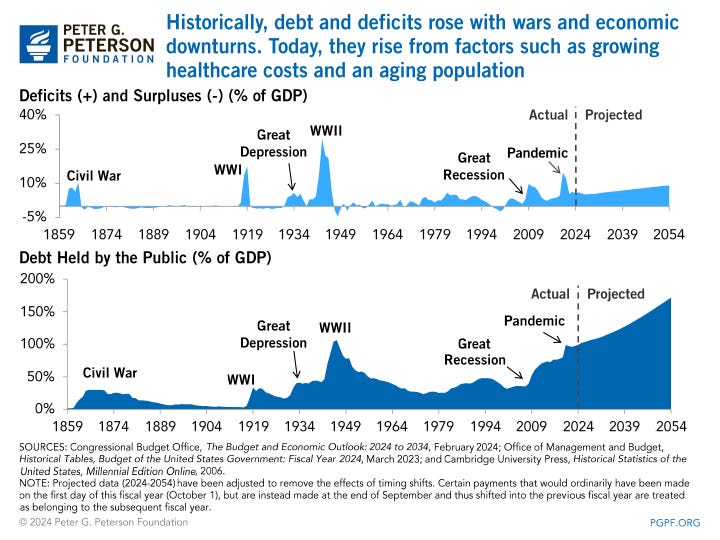

Then we have those in Congress who feel the government can borrow indefinitely without consequence. Federal borrowing increases the national debt, leading to higher interest rates as lenders demand higher returns. This raises the cost of borrowing for businesses and consumers, stifling growth and increasing inflationary pressures. Ignoring this link between debt and inflation shows a lack of understanding.

Proposals to fix inflation by implementing price controls, like capping the price of gas or food, ignore the economic reality that price controls create shortages. When prices are capped below the market level, producers have less incentive to supply goods, leading to scarcity and black markets. It is shocking how few know about the Law of Supply & Demand. We have people running for president right now who feel price controls are an effective way to control inflation, which is absurd.

Some legislators continue to argue that government spending doesn’t directly cause inflation. However, when government spending outpaces tax revenue, it often relies on borrowing or printing more money, both of which increase the money supply. This additional money chases the same amount of goods, pushing prices up. Claiming no link between spending and inflation shows a clear gap in economic understanding.

The belief that deficit spending always stimulates economic growth without considering long-term effects like inflation demonstrates ignorance of fiscal responsibility. While short-term stimulus can boost demand, unchecked deficit spending can lead to too much money circulating in the economy, driving prices higher. Ignoring the balance between fiscal stimulus and inflation risks shows an incomplete grasp of economics.

These are only some of the examples that highlight how ignorance of basic economic principles among our elected officials can lead to misguided policies that worsen inflationary pressures and adversely affect the poorest among us. Congress needs to understand that its fiscal decisions have real consequences for the economy, and reckless spending can fuel inflation, hurting the very people it claims to help.