Balancing the Budget: A Strategy for Cutting Waste, Creating Jobs, and Securing America’s Economic Future

How a New Approach to Fiscal Responsibility Could Transform the U.S. Economy and Tackle our $36 Trillion National Debt

I have written about it many times in the past, hopefully, this time with a slightly different take that won’t make you fall asleep, but the United States faces a serious challenge: our national debt exceeding $36 trillion. At the same time, traditional budget-balancing efforts have not worked, and our elected politicians continue spending like fools. Even the recently passed CR continues Biden’s spending through September. Now that September is over, policymakers and experts have proposed a multifaceted strategy to address this issue through a combination of waste reduction, revenue generation, and regulatory reforms. Let’s explore the key components of this strategy, which has the potential to create a more efficient federal government, create jobs, and secure the nation’s economic future.

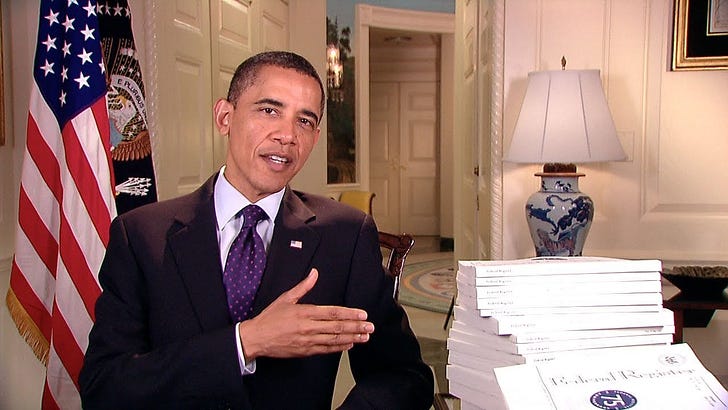

Just a quick note that cutting government waste and lowering spending have been proposed by most presidents, including Bill Clinton and Barack Obama:

This new plan aims to cut at least $1 trillion from the federal budget by identifying and eliminating inefficiencies, including targeting fraudulent disability claims—where individuals receive benefits while secretly working full-time—and reducing bureaucratic overhead. As I said, the multi-faceted strategy emphasizes that these cuts will not reduce benefits for those who are supposed to receive them, such as Social Security recipients or Medicare beneficiaries. Instead, the focus is on ensuring that taxpayer dollars are used efficiently while eliminating fraud and abuse. Something people from all walks of life can get behind.

The plan seeks to make government operations leaner and more efficient by redirecting resources from non-productive areas to more impactful sectors. This approach could free up funds for critical areas like education, healthcare, or infrastructure, benefiting the public without increasing the tax burden.

Another key strategy component is using tariffs to generate revenue and encourage domestic production. Tariffs are simply taxes on imported goods from other countries and have historically played a role in funding government operations. While I am not opposed to reciprocal tariffs, I am strongly opposed to all others, especially punitive tariffs. But, let’s get back to the proposed tariff plan to raise $1 trillion through strategically applied tariffs. Critics like me argue that tariffs will lead to higher prices and inflation in the consumer. In addition, inflation is also driven by monetary policy—such as the Federal Reserve’s money supply decisions—moreso than tariffs. Historical data supports this view, showing that inflation spikes often correlate more with money printing than with trade policies. As found by the Peterson Foundation, “whether due to a surge in government spending or a central bank printing too much money — prices can rise.”

Admittedly, by incentivizing domestic production, tariffs could create domestic jobs and reduce reliance on foreign manufacturing, though this rarely works long-term. Often, we see, like we do today, the announcements of adding tens of thousands of manufacturing jobs while protecting the existing American jobs in whatever industry is affected by certain tariffs, as we saw with Trump’s 2018 tariff war with China. This new plan highlights Elon Musk’s commitment to $2 trillion in domestic production, which could lead to higher-paying jobs and increased economic activity, if sustained.

The strategy introduces an innovative concept known as the “Trump Gold Card,” allowing wealthy individuals worldwide to purchase the right to live and work in the United States. This is simply the adoption of a strategy by other countries with the aim of attracting global talent while generating significant revenue. The plan estimates that selling 7 million Trump Cards could bring in billions, with 37 million people globally capable of affording them. How many of them will actually do it is an unknown, but it is reasonable many will pay the money for a quick and “easy” way to establish themselves in the U.S.

While some may view this as a program favoring the wealthy, proponents argue that it could bring top-tier innovators, scientists, and entrepreneurs to the U.S., boosting the economy and fostering technological advancements. Personally, I have no issue with it as, so long as they are vetted, I’d welcome them to the country. The revenue generated could be used to fund essential programs, such as Social Security, or pay down our debt, all the while not increasing taxes on middle-class Americans. This market-driven approach offers a way to strengthen the nation’s financial position while enhancing its global competitiveness.

Another component of making the government more efficient is regulatory reforms. As technology evolves rapidly, the U.S. must balance innovation with security. The strategy calls for reforms that maintain American leadership in AI while allowing for global collaboration. This includes addressing export controls on advanced technologies, such as Nvidia chips, to ensure they do not fall into the hands of potential adversaries—good luck with that.

Additionally, the reform plan highlights the importance of developing post-quantum cryptography to protect against future cyber threats. These reforms are designed to keep the U.S. at the forefront of technological innovation while safeguarding national security. By fostering a regulatory environment that encourages private-sector innovation, the strategy aims to ensure that America remains a global leader in the tech race.

Another new element of the strategy is the creation of a sovereign wealth fund, which would generate revenue through strategic investments. Modeled after successful funds in countries like Norway, which uses its oil wealth to invest globally, the U.S. would focus on profitable ventures supporting government operations. The revenue from this fund could be used to strengthen social programs like Social Security, boosting their long-term sustainability without raising taxes.

This approach offers a market-driven solution to our fiscal challenges. It provides a sustainable source of income that reduces reliance on debt financing. By making smart investments, the fund could generate returns that benefit both the government and the public, creating a win-win scenario for the country’s financial health.

The DOGE strategy for the next fiscal year presents a smart approach to addressing the nation’s budgetary challenges. By cutting waste, generating new revenue streams, and implementing targeted regulatory reforms, the plan aims to balance the budget while fostering economic growth, something no administration has been able to pull off for a very very long while. While some elements—such as tariffs and the Trump Card—may cause debate, the strategy’s focus on efficiency, innovation, and opportunity should be appealing to a wide range of Americans.

For those concerned about the future of social programs, the plan is focused on protecting benefits, not removing them, for the deserving while eliminating fraud should offer reassurance. For workers and communities impacted by globalization, the push for domestic production could bring new jobs and economic vitality. And for those worried about America’s place in the world, the regulatory reforms and global talent initiatives aim to keep the U.S. competitive globally. It’s a multi-faceted strategy that, if allowed to move forward, may actually get us out of this mess prior Congresses and presidential administrations have gotten us into.